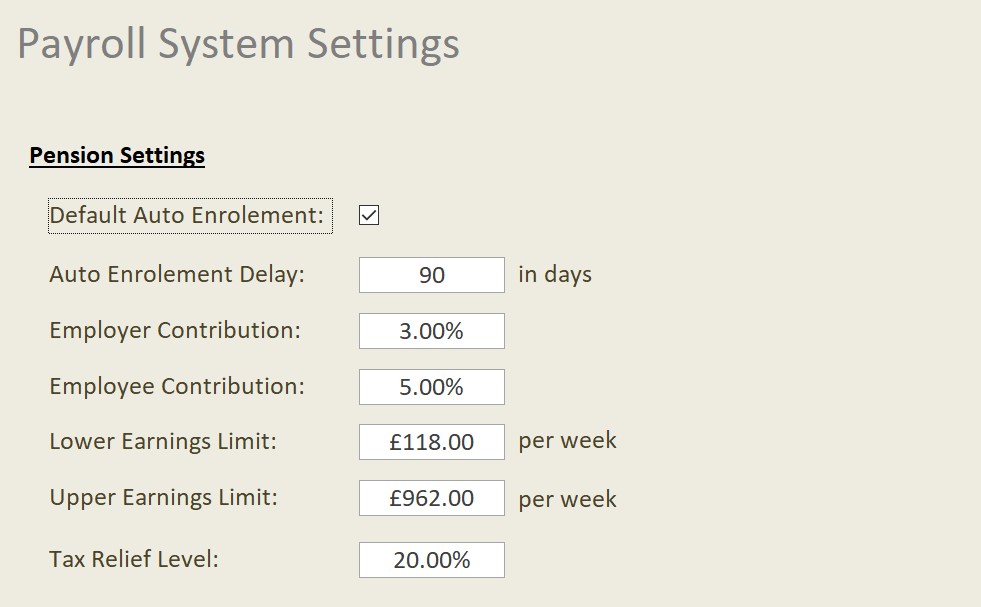

We have added support for pensions within the system. As mentioned earlier, we have some specific settings for pensions: –

|

Setting |

Description |

|

Default Auto Enrolment |

When a staff member is added to the system is the default behaviour to enrol them onto the company pensions. |

|

Auto Enrolment Delay |

As a business you can choose to delay enrolment by up to three months if you wish. The default is a 90 day delay. |

|

Employer Contribution |

The current minimum is 3% for employers to contribute. |

|

Employee Contribution |

The current minimum is 5% for the employee to contribute. |

|

Lower Earning Limit |

This is the lower earnings limit per week of National Insurance contributions. Any monies below this limit does not form part of your pension calculation. |

|

Upper Earning Limit |

This is the higher earnings limit, per week, of National Insurance contributions. Any monies above this limit does not form part of your pension calculation. |

|

Tax Relief |

Currently set at 20%, the employee receives this on any contributions. In reality this reduces their contribution to 4%. |

Payroll Calculation

To work out pensions, it is best to work through an actual calculation so you can see how the contributions are calculated.

Employee A works a pay period from 29th April 2020 until 26th May 2020. Their total gross pay for this period is £1,500.

The pension contributions are calculated as follows: –

Qualifying Earnings = £1,500 less the lower earnings threshold.

To calculate the lowers earnings threshold we need to dividend the £120 by 7 to provide a per day amount and multiple this by the number of days in the pay period.

In our example above there are 28 days in our pay period (inclusive). The lower earnings threshold is calculated as: –

120 / 7 X 28 = 480

This means that in our example the Qualifying Earnings will be £1,020.

The employee’s contribution is set at 5%. However, they receive 20% Tax Relief on these contributions which equates to 1% reduction. So, the employee’s contributions would be: –

£1020 x (5% less 1%) = £40.80

The employer contributions are set at 3%: –

£1020 x 3% = £30.60

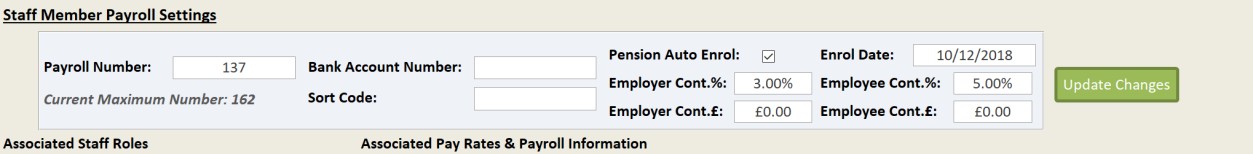

Settings Pension Levels for Staff

Within the Manage Pay Rates area you can set the pension contribution levels: –

You can set whether the staff member is enrolled, their enrol date, contribution levels and any additional contributions in cash either the employee or employer want to make.

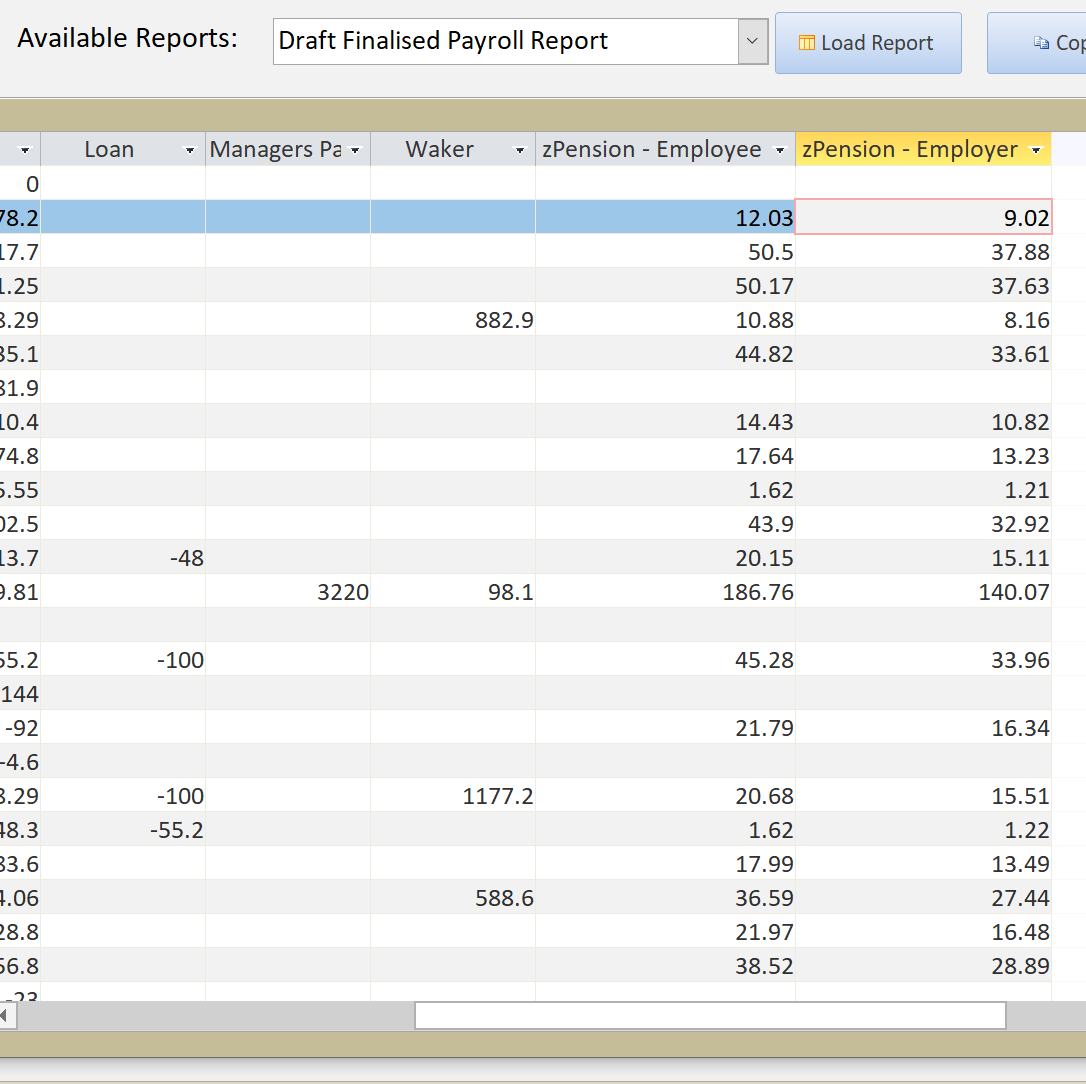

Seeing Pension Payments

You can see the Pension Payments within the Finalised Payroll Report. They appear as two columns at the end of the report: –

The two columns are called zPension – Employee and zPension – Employer. They have a leader “z” to ensure they appear at right hand side of your report.

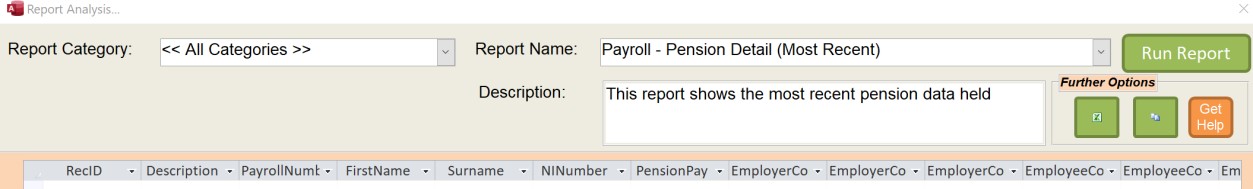

You can also see a detailed report on any pensions payments through the following report: –

This report contains a breakdown of any pension payments made and can be used when you have to update your Nest or other Pension provider details.